Research Article | DOI: https://doi.org/ISSRR-RA-25-001

The Influence of Attitudes Subjective Norms and Perceived Behavioral Control

Abstract

The financial management of individuals varies around the world. With rapid economic growth there is an alarming increase in the value of products and services that challenge people who have poor financial management. As a result, it requires individuals to manage their financial resources through appropriate saving behavior. This paper, therefore, attempts to investigate behavioural factors that influence individuals’ intention to save money. Using extended theory of planned behaviour, three predicting variables were constructed that include attitudes, subjective savings norm, and perceived behavioural control. The study hypothesized that attitudes, subjective norms, and perceived behavioral control had a positive relationship with intention to save money. Using a questionnaire survey distributed randomly to 2500 respondents, of which 1192 had completed the questionnaires, the hypotheses were tested using correlation and linear regression analysis. The findings indicate that all three predicting variables have a positive and significant relationship with intention to save money. Specifically, perceived behavioural control is the strongest predictor to engage in savingbehaviour. Future studies should try to examine psychosocial factor such as culture that may also have some effect on intention to save money.

Introduction

Since there is fast growth for global economic in recent years, the financial management of the people varies around the world. People need to possess a sound financial management in order to enable them to maintain a satisfied life with basic necessities. However, a rapid growth of economic that causes increase in the value of products and services gives challenges to peoplewho have poor financial management. Thus, it requires people to manage their financial resources through savings. Saving is the portion of income not being spent for current expenditures. In fact, all around the world, the saving behavior provides economic security of a safety net. Usually, people save money because they do not know what will happen in the future and the money that has been saved can be used for unexpected events or emergencies. The savings can be used for car, home, education, comfortable retirement, children, medical or other emergencies, periods of

unemployment or caring for parents. Thus, through savings it can provide money for the things that people want or need in the future. However, without savings, it can cause a large financial burden when unexpected events occur. This is because when there is no saving, an individual or family will have no financial security to face uncertainties.

Individuals have greater responsibility in determining their own saving as part of income earned. Thus, the attitude towards savings varies differently around the world. Usually, people choose not to save money because of the other financial priorities. For instance, basedon the data obtained from World Deposit Rates (2015), the countries in North America, Australia/Oceana and Africa have low savings rates. In North America, the savings rates is up to 4%, Australia/Oceana savings rates is up to 5.35% and savings rates of Africa is up to 7%. By choosing not to save, it probably becomes the biggest financial mistake that they make in their life. While in other countries, there are also some people who have a tendency to save. Those people have efforts to put away money regularly for their savings so that it can be used for emergencies. In the Middle East, they have saving rates up to 10%, Asia savings rates is up to 10.50%, Europe saving rates is up to 12% and South America savings rates is up to 16% (World Deposit Rates, 2015). Certainly, people in Middle East, Asia, Europe and South America tend to save money for the long-term because they always think of their financial protection when they become seriously ill, disabled or have an accident.

Data obtained from World Deposit Rates (2015) shows that countries in Asia have a tendency to save more money compared to people from North America. In Asia, the savings rate is quite high with the rate of 10.50% to ensure a sustainable investment growth while only 4% saving rate in North America. Usually, in public sector, most of the workers will choose government pension scheme since they will have no worries with their post retirement expenses. This is because government pensioners will receive monthly pension which is half of their last drawn salary. Thus, pensioners can plan wisely on how they should manage their pension every month. Unlike public sector, employees of private sector and non-pensionable public sector employees will receive their money that they contribute every month in lump sum once they retire. The private sector employees and non-pensionable public sector employees are compulsory to contribute 11% of the salary and another 13% comes from their employer if their salary is RM5000 and below. Meanwhile, for employees with salary more than RM5000, they need to contribute 11% of their salary and another 12% from the employers. With savings it can help the retirees to continue livings with the money that they save in the hope that the money will be spent wisely. Thus, it requires the retiree to have a good financial management to safeguard their well- beings after they retire.

Malaysia is a developing country and has experienced fast economic growth as a result of high rates of savings and investment. It has drastically changed the pattern of savings and investment of the people due to the rapid economic transformation from resource-based to market-based economy. Based on the result from Nielsen Global Survey of Saving and Investment Strategies, 48 percent of Malaysians is actively saving to cover for their future health issues, while another 48 percent plans to start their savings in the future. Also 43 percent of Malaysian saves for unexpected household emergencies and retirement funds (Malaysian Consumers, 2014). For savings and investment, based on the report obtained from the Household Income Survey (HIS), it has been identified that 90 percent of the Malaysian rural households and 86 percent of the Malaysian urban households have no savings with 88 percent majority of the Malaysian households have zero earnings from their savings, while for investments it has been identified that 50 percent of Malaysian urban households and 66 percent of Malaysian rural households have investments but 57 percent of Malaysian households have zero earnings from their investments (Anisah, 2014).

Since Malaysia aims to become a high-income nation by the year 2020, it is important for the country to have high savings rate (Mahalingam& Wei-Shen, 2013). According to a report obtained from Minister of Agriculture (2014), the population of the country was expected to grow to 34.3 million by year 2020, in which this number increased from 30.6 million in 2015 (Malaysia population, 2016).

Because more people are expected to retire at the age of 60 and above, thus, they need to save money so that it can be used to finance their life once they retire. This is due to physical health that becomes an indicator to determine life satisfaction of aging population (Mary, Ming, & Lee, 2015). The considerations on physical health can create challenges to people that retire because with the increasing costs of health care can be a burdento people, thus, they need more money to be spent so that they can have a good life satisfaction. Once they retire, they no longer have medical protection from their employers for outpatient treatment in a clinic, dispensary or hospital, or actual hospitalization, or visits of a doctor (RooshidaMerican, 2010). As a result, they have to start buying insurance premiums for medical care to protect themselves from any medical conditions (NikRosnah&Eng, 2009).

2. Research Issues

The rapid growth of the population throughout the world has depressed savings per capita and retards growth of physical capital per worker. It has created concern and challenges throughout the world. This is because of capital-reducing effect in which there is no increasing amount of saving due to the rapid growth of the population that has lowered down the ratio of capital to labor (Kelley, 1988). Savings among people in developing countries is still very low since many people do not have awareness on the importance of savings for emergency and giving them access to credit when needed.The percentage of adults that does not have any savings at financial institution is 56 percent while only 28 percent of adults which represents 1.2 billion adults in developing countries agree that the saving is important for emergency use (The World Bank, 2016). According toDemirguc-Kunt and Klapper (2012), adults from Sub-Saharan Africa, and East Asia were reported to have very little savings at formal financial institutions. Thus, it shows that the level of awareness among adults is very minimal with the low percentage of adult’s savings in developing countries.

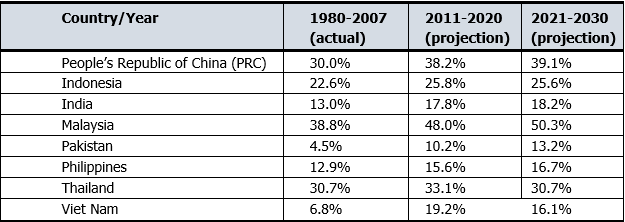

Apart from that, in 2010, the saving rates contribution to the world from developing countries was 45 percent and it is expected to have high increasing saving rates to 62 percent by 2030 and at that time, the developing countries will experience rapid growth in output, rapid growth in population in the regions with relatively young populations. In developing countries (Table 1.1), the saving rates of past and future domestic will likely to have a slightly changes within these two decades. Malaysia’s saving rates in 1980 to 2007 is 38.8 percent is projected to be 48 percent in 2011 to 2020 and 50.3 percent in 2021 to 2030, an increase about 11.5 percent from 2007. The higher percentage of saving rates in developing Asia by 2030 will belong to Malaysia when 50.3 percent out of all other countries in developing Asia followed by People’s Republic of China (PRC), 39.1 percent and Thailand 30.7 percent (Lee & Hong, 2010).

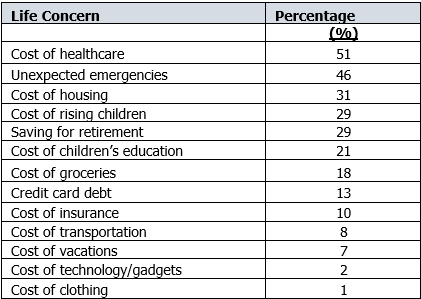

In spite of having many continuous supports from the government and private organization that encourage the savings behaviors among Malaysians, individuals are supposed to have self- awareness on the importance of savings in life. This is because they usually need to have savings for retirement, paying loans, funding children’s education and other investment activities (Azwadi et al., 2013). A serious concern should be given by individuals so that the accumulated savings can cover for their needs. Additionally, it is also for the purpose of preparing individuals with their responsibilities of funding personal or family healthcare needs as well as to provide an adequate fund for their children’s education since the increasing cost of education every year. The savings fund can be considered as a source of

financing or investment to meet long-term goals. Thus, it requires a proper money management and the individual’s ability to save for long-term goals that can protect them from severe financial crises. Table 1.2 below depicts the priorities ofMalaysians on some specific items. For example,51 percent indicates cost of healthcare as the highest priority followed by unexpected emergencies (46 percent), cost of housing (31 percent), raising children (29 percent), saving for retirement (29 percent), and others. As such, it is imperative that individuals who have a proper financial planning will be able to successfully save money since they have a wide variety of saving priorities in life. However, individuals that do not have enough savings will be facing certain problem in their life because they do not manage their money wisely according to their priorities. Inadequate savings will also negatively affect the life of the individuals, thus lead towards the uncomfortable life. For example, lack of savings leads to other health problems like having lack of sleep (Delafrooz&Laily, 2011a).

The good savings behavior will be successful if individuals design their own savings plan in good ways by practicing savings more than buying. Those individuals that have problem in making the savings plan when experience unexpected events may experience certain hardship in life and it can threaten the household well-being like food insecurity, failure to access to medical care and housing instability. There are several factors of financial problems that can cause an individual employee to experience hardship in their life such as overuse of credit, reckless spending and lack of planning due to low level of financial literacy (Garman &Forgue, 2009). In addition, Thunget al. (2012) claimed that some Malaysians were having problems related to financial planning for future like lack of saving awareness, lack of budgeting, overuse of credit, overspending, inadequate shopping and spending skills, low salary also lack of knowledge about money. Admittedly, according to a report by Ling (2007), it has been identified that some Malaysian people are still not having financial planning for their future or retirement. The lack of awareness on savings behaviors will definitely determine the amount of savings and the life satisfaction of an individual.

The attitude towards savings is undoubtedly very important for all employees in both public and private sectors in Malaysia especially those individuals who are nearing to retirement. Savings becomes a reliable source and convenient ways to face with economic shocks. It can also help the employees to use the money that they save during their working time as their retirement incomes. With their own savings, it enables the employee to continue living using their retirement incomes, invest in their children’s education and nutrition also allows them to have a better life by spending for health treatment once they retire. Thus, savings give a lot of benefits to an individual. Yet, not all individuals are financially prepared to do so because many employees are having poor financial behavior.

This study aims to explain self-reported saving behavior with a model derived from the Theory of Planned Behavior (TPB), extended with constructs we consider particularly relevant to the domain of intention to save money: attitude, subjective saving norms, and perceived behavioral control. The model may help to inform and guide individual risk management strategies to improve saving for a financial buffer in the future.

3. CONCEPTUAL AND OPERATIONALIZATI- ON OF CONCEPTS

Actual Savings Behavior

In this study, the actual behavior can be understood as a function of an intention to act (Carmack, 2007). In addition to this, the actual savings behavior derived from an individual’s savings intentions that play an active role to determine their actual savings behavior; in which the savings intention becomes a good predictor of the actual savings behavior (Kiriakidis, 2015). In order to be able to understand this, the individual’s savings behavior in wealth accumulation will be made based on the individual’s choices either to save or spend their wealth earlier in life (Friedman, 1953). Consequently, with the actual savings behavior, it will lead towards the feedback about the expectations of savings behavior (Egmond et al., 2007). Hence, for the purpose of this study, the actual savings behavior can be measured using these indicators; household-level and individual level (González &Özcan, 2008). For household- level, the savings can be measured through the households’ ability to save, households’ savings that will be made at the end of the month by considering the income and expenses, the savings that derived from any other savings activities made by the households and the negative savings involving the households’ debt whereas for the individual level, the actual savings behavior can be measured by looking at the changes of the savings that has been made in the bank or other financial institutions for the previous 12 months.

Theory of Planned Behavior

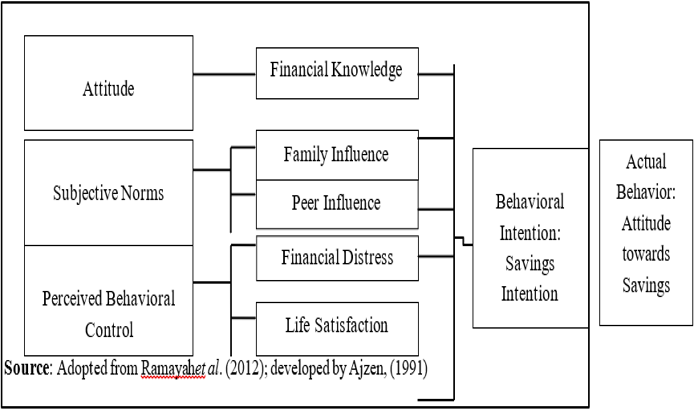

The Theory of Planned Behavior (TPB) was first proposed by IcekAjzen in 1985 (Ajzen, 1991) and it is an extension Theory of Reasoned Action (Fishbein&Ajzen, 1975; Ajzen&Fishbein, 1980). TPB has been applied to research related to mindividual’s behaviors in specific contexts (Ajzen, 1991), such as savings behavior (e.g. DeVaney&Chiremba, 2005; Dulebohn, & Murray, 2008; Collins, 2010; Croy et al., 2010; Davis &Hustvedt, 2012; Kisaka, 2014; Magendans, 2014). In addition to this, as mentioned by Ajzen (1991), the predictors of any individual’s behavior are the formation of an intention towards that behavior; in which intentions are determined by the individual’s attitude towards the behavior, the subjective norm and perceived behavioral control. Certainly, in this study, savings intention becomes the predictors of attitude towards savings. Figure 1depicts the relationship between the independent and the dependent variables.

Attitude towards Savings

Attitude as defined by Eagly and Chaiken (1993) is a psychological tendency that is expressed by evaluating a particular entity with some degree of favor or disfavor. Meanwhile, saving is defined as the change in non-human wealth (Solmon, 1975; Gali, 1990). Thus, attitude towards savings is conceptualized as individual’s behavior that reserves part of the income earned for future purposes by choosing not to spend it immediately. Attitude towards savings also can be determined by four variables: financial knowledge, family influence, peer influence, financial distress, and life satisfaction. These variables are used to evaluate how it can predict the employees’ savings attitude.

Attitude

The first determinant of TPB is attitude. Based on the TPB, it is claimed that an attitude becomes the important determinants of individual’s behavior (Zimmerman et al., 2015). In addition, it is important to note that Ajzen (1991) refers attitude as how an individual make a favorable or unfavorable evaluation of any behaviors. For this reason, the financial knowledge was seen to influence individual’s attitudes towards savings. To examine whether attitude influences saving intention, we add this construct to the model with the assumptions that individuals exhibit a stronger saving intention when they feel their action is favorable.

Subjective Norms

For the second determinant of TPB, it is known as the subjective norm of the individual. The subjective norms can be defined as the individual’s perception to perform or not to perform behaviors, in which that perception derived from the social pressure (Lin & Chen, 2011). Despite this, subjective norms also will involve with individual’s belief to engage with certain behavior, where other person in their lives thinks that it is significant to engage with that behavior (Ajzen&Fishbein, 1980; Armitage & Conner, 1998). Further, for the purpose of this study, subjective norms will comprise variables of family influence and peer influence that can influence the savings attitude of the individuals. As such, subjective saving norms were added to the model as a predictor of saving intention: positive subjective saving norms are expected to predict a stronger saving intention.

Perceived Behavioral Control

The third determinant of TPB is known as perceived behavioral control. Ajzen (1991) had explained about perceived behavioral control; it is referring to a degree to which an individual anticipate of easy or difficulty in performing the behavior by considering the past experiences and future obstacles to ensure the ability to perform that behavior. In addition to this, it is important to note that in this study the perceived behavioral control will comprise of financial distress variable in order to measure the attitude towards savings. The model therefore assumes that perceived financial self-efficacy influences saving intention behavior: individuals with a high financial self- efficacy are expected to have both a stronger saving intention and to report more saving behavior.

4.REVIEW OF THE WORK

In addition to this, for the past few years, the participation and contribution in retirement savings among employees in Malaysia are relatively low and critical. The low of savings was found particularly among the baby boomers (Bernheim&Scholz, 1993; Read, 1995; Lusardi, 1999) and this will give negative impact towards their life after retirement and influence their happiness and well-being in the future. Based on the financial report made by HSBC in 2014, it was stated that the percentage of pre-retirees around the world worries about not having enough money to finance them after they retire has risen from 66 percent to 88 percent (Kanyakumari, 2015). Thus, it shows that most of the employees who are near to the retirement feel unhappy when their retirement savings is insufficient to support them when they are no longer working. On the other hand, in the United States the personal savings rate declines for the past 20 to 30 year and thus shows that Americans are saving less in their life (Hurd&Zissimopoulos, 2000). On the contrary, the savings rate in other European countries such as France, Germany and Sweden is higher than 10 percent for the past 30 years (Kramer, 2013).

Saving is often viewed as having some degree of difficulty or lack of self-control among the households in reducing the current consumption so that it can enable them to save for future consumption (Thaler&Shefrin, 1981). This is because, saving involves individual’s estimation of income for future use and decision on how much individuals should consume their financial resources over their life (Fontes& Gutter, 2006). Hence, it can be understood that individual’s life cycle gives influence towards the savings for future (Ando & Modigliani, 1963). In addition to this, the discussion on the savings all around the world focuses on the inability of most people to make a sufficient savings to provide a comfortable live such as for health security, a higher education for each child also for retirement security (Richman, 2007). In particular, the declining and low savings rate was found among the households in the United States, Canada, United Kingdom, New Zealand and Australia from 1983 to 2000 (OECD, 2000; Orr & Purdue, 2001; “The Shift”, 2005).

Realizing on the importance of savings, starting from 1990s, most of the households in America starts to have savings even though their net income is not high (Maki & Palumbo, 2001).What is more, the government of United States has increased its regulation so that the employees will contribute more to a retirement savings account by implemented the 401(k) plans in 1978 in which later gained its popularity during the 1990s and 2000s. Under the 401(k) plans, it allows the employees to decide whether to make voluntary contribution and how much to contribute to the retirement account; in which it is an individual accounts that has been accumulated from the employer and employee contribution also from earnings that the employees decided to invest (Wiatrowski, 2008). Apart from that, the government also had implemented other policies for the benefits of the Americans such as The Tax Equity and Fiscal Responsibility Act (TEFRA) in 1982, The Deficit Reduction Act of 1984 (DEFRA) and The Retirement Equity Act of 1984 (REA) in 1984, The Tax Reform Act (TRA 86) in 1986, The Older Workers Benefit Protection Act in 1990, The Unemployment Compensation Amendments in 1992, The Omnibus Budget Reconciliation Act in 1993 and The Small Business Job Protection Act (SBJPA) in 1996 (“A Timeline”, 2010). To put it briefly, the government of United States had seen the problem of low savings for retirement as a serious problem that needs to be given attention so that the Americans are all prepared for their retirement by having enough money that can ensure them to live comfortably during retirement years.

Obviously, governments in other countries also come out with a proper plan in order to boost the savings rate and at the same time cater the needs of the employees for their retirement. For instance, in Canada, the government is responsible of financing the retirement of employees through a within registered retirement savings plans in which it is a combination of defined contribution pension plans and private savings plan starting from 1990’s (“The Changing State”, 2007). Other than that, in the United Kingdom (UK), there are two schemes been introduced known as Individual Savings Accounts (ISAs) in year 1999 and Child Trust Funds (CTFs) in year 2005-2011. These two universal schemes were implemented in the late 1990s to replace the previous government saving schemes which are Tax Exempt Special Savings Accounts and Personal Equity Plans (Searle &Köppe, 2014). The main objectives of implementing the Individual Savings Accounts is to encourage people especially those who are lower income earner to have savings and have finance for long-term care (Banks et al., 1997). Whereas, the aims of implementing Child Trust Funds scheme is to change the saving habit of low income households also instill the attitude to save for future in their life (Searle &Köppe, 2014.

Methodology

Data were collected with a questionnaire and analyzed using correlation and regression. Participants were randomly chosen from phonebook list and working individuals through email (snowball sampling) and online message boards (convenience sampling). This sampling approach was chosen to increase heterogeneity by including people with a potentially unclear financial situation (i.e. students) together with those who had a more stable, and potentially full- time, income. Before starting the questionnaire, participants were presented with an accompanying letter that included the research description and privacy assurances. By randomizing statements and page order, we prevented order-effect bias.

7.Discussion

This study aimed to identify potential determinants of intention to save money. For this, the TPB-based model assumes that intention to save money is predicted by attitude, subjective norms, and perceived behavioral control. Results indicated that all three independent variables positively predicted intention to save money. This finding is consistent with the earlier studies that predicted attitude, subjective norms, and perceived behavioral control have a positive and significant relationship with intention to save money.

First, the model assumes that saving intention is predicted by attitudes, and attitudes indeed predicted saving intention. Furthermore, this TPB- derived relationship predicts saving intention better than other models. This suggests that specific and fine-grained measures of attitude are a feasible line of inquiry for TPB-based studies.

Second, as expected, perceived behavioral control predicted money: the more obstacles participants perceived, the less saving behaviour reported. Saving intention, in turn, influenced perceived saving barriers: the stronger the intention, the fewer barriers seen.

In sum, our model not only confirms meta- analytical findings which showed that the TPB predicts a wide range of behaviours (Armitage and Conner 2001Armitage, Christopher J., and Mark Conner. 2001. “Efficacy of the Theory of Planned Behaviour: A Meta-Analytic Review.” British Journal of Social Psychology 40

(4): 471–499), it also explains the importance of perceived behavioral control as the strongest predicting variable to intention to save money.

Taken together these findings suggest that adapting the TPB to domain-specific attitudes and behavior using different cultural context is a viable approach.

Limitations of the current study include the fact that we did not examine actual behaviors but used the less privacy-invasive measure of self-reported behavior. Suggestions for further research include using different psychosocial constructs such as culture that may have some effect on intention to save money. Additional research can also examine other risk-mitigating financial products besides a saving account (e.g. insurance), whose relative popularity might depend on an individual’s risk tolerance.

References

-

Ajzen, I., & Driver, B. L. (1992). Application of the theory of plannedbehavior to leisure choice. Journal of Leisure Research, 24(3), 207-224.

View at Publisher | View at Google Scholar -

Ajzen, I., &Fishbein, M. (1980). Understanding attitudes and predicting social behavior, Englewood Cliff s, NJ: Prentice-Hall.

View at Publisher | View at Google Scholar -

Ajzen, I., & Madden, T.J. (1986). Prediction of goal directed behavior: Attitudes, intentions, and perceived behavioural control. Journal of Experimental Social Psychology, 22, 453-474.

View at Publisher | View at Google Scholar -

Anderson, A. G., & Lavallee, D. (2007, in press).Applying the theoriesof reasoned action and planned behavior to athlete training adherence behavior. Applied Psychology: An International Review. Anderson, J., & Gerbing, D. (1988). Structural equation modellingin practice: A review and recommended two-step approach.Psychological Bulletin, 103(3),

View at Publisher | View at Google Scholar -

411-423.

View at Publisher | View at Google Scholar -

Arbuckle, J. L., &Wothke, W. (1999). AMOS users’ guide version 4.0,Chicago, IL: Smallwaters Corporation. Bobek, D. D. (1997). Tax fairness: How do individuals judges fairness and what effects does it have on their behavior.(Ph.D. Dissertation).Universityof Florida, Gainesville.

View at Publisher | View at Google Scholar -

Bobek, D. D., &Hatfield, R.C. (2003).An investigation of the theoryof planned behavior and the role of moral obligation in taxcompliance.Behavioral Research in Accounting,15, 13-38.

View at Publisher | View at Google Scholar -

Browne, M.W., &Cudeck, R. (1993). Alternative ways of assessing modelfi t, in Testing structural equation models. K.A. Bollen and J.S. Long,(Eds.) Newbury Park, CA: Sage, 136-62.

View at Publisher | View at Google Scholar -

Budi Wahyono. 2013. Pengaruhpendi - dikankewirausahaanterhadapniatberwirau sahasiswasmknegeri 1 pedantahun 2013. Tesis.PPs UNS.Elliott , M. A, Armitage, C. J., &Baughan,

View at Publisher | View at Google Scholar -

C. J. (2003). Driver’s compliancewith speed limits: an application of the theory of planned behavior. Journal of Applied Psychology, 88(5), 964-972.

View at Publisher | View at Google Scholar -

Fang, K., & Shih, Y. (2004). The use of a decomposed theory of plannedbehavior to study internet banking in Taiwan. Internet Research, 14(3), 213-223.

View at Publisher | View at Google Scholar -

Farrell, S. & Tapper, E. (2007).Student loans: The failure to consolidate an emerging political consensus, United Kingdom: University of Sussex.

View at Publisher | View at Google Scholar -

Fatimah Wati, I., Jamalludin, S., Rosni, B., Norehan, A, & SitiAznor, A. (2002). Returns to investment in higher education in Malaysia.Sint k: U niversitiUtara Malaysia.

View at Publisher | View at Google Scholar -

Fishbein, M., &Ajzen, I. (1975).Belief, attitude, intention, and behaviour: An introduction to theory and research, Reading, MA: Addison-Wesley.

View at Publisher | View at Google Scholar -

Fishbein, M., &Ajzen, I. (1975).Belief, attitude, intention, and behavior: An introduction to theory and research. Philippines: Addison-Wesley Publishing Company. Fishbein,

View at Publisher | View at Google Scholar